How does it benefit you

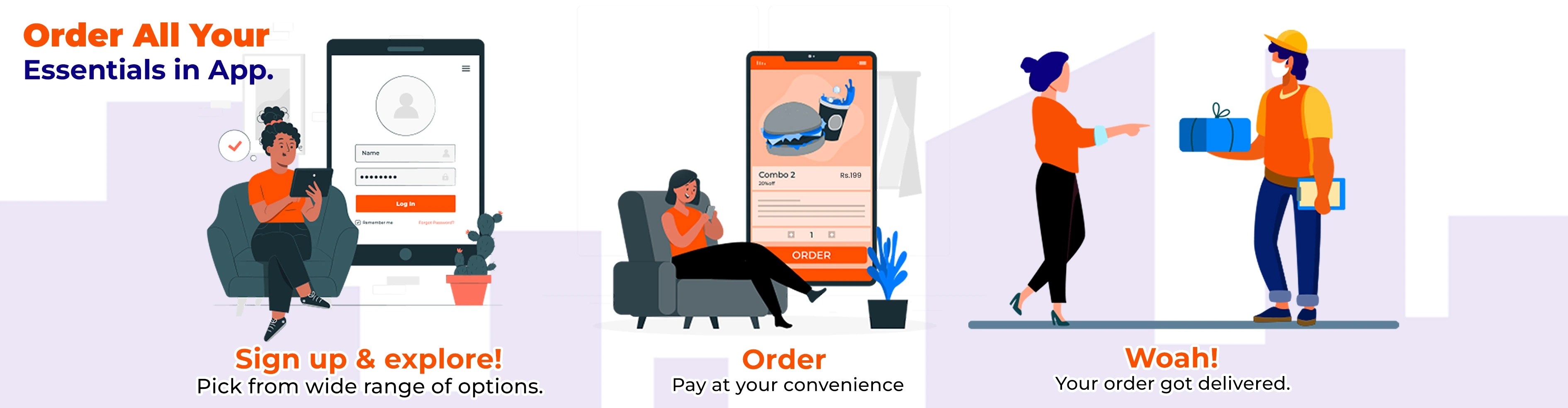

Signup & Explore!

Pick from wide range of options.

Order

What you're looking for and pay at your convenience

Woah!

Your order got delivered.

Create

Your business account on nextclick. and help users discover your Business

Deliver

Your order to thousands of customers with ease

Start earning

from your online business & grow your business online.